That being the case, then why are they doing it? The only other reason city officials have given for the implementation of the tax, is the cost of storm water and flood control and so far, the only examples given of the costs of storm water and flood control have been curbside brush pick up and street sweeping. I'm pretty sure the city has been performing those functions since 1907. They claim the city has been absorbing the costs of storm water and flood control for years now and now need to pass the estimated $532,000.00 annual tax to fund storm water and flood control. If storm water and flood control have become such a huge financial burden on the city, that should be reflected in their budget. Let's see if we can find it.

The Federal Clean Water Act has been around since 1977, the Tennessee Water Quality Control Act followed shortly thereafter. Over the next thirty years, both the feds and the state continued to add certain management requirements to prevent water pollution of streams and rivers. Most of those requirements pertained to water runoff. The regulations coming from the federal and state government did require local governments to take certain steps to minimize silt and pollutants from running into rivers and streams.

For the years Lenoir City has been practicing storm water and flood control management, it was handled through the city codes enforcement office and the work required was handled by the street department. In 2004, the state passed the law that allowed certain local governments to pass the rain tax. So for at least 13 years, the city hasn't seen the need for the rain tax. Now suddenly the tax is needed.

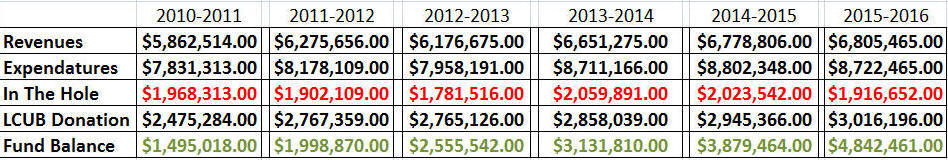

The mayor and city officials claim the costs of storm water and flood control have gotten so high they need the tax. But according the the city budget audits, there's no evidence the street department or the codes enforcement budgets have increased by any drastic amount since 2010. In fact, the overall city budget has been doing pretty well in the same time.

The table below shows the city budget from 2010 thru 2016. Revenue, expenditures, how far they went in the hole before the LCUB donation, the LCUB donation to the city and the fund balance.

So the Rain Tax is not mandated and the city budget is good with a 4.8 million dollar fund balance. So why the Rain Tax?

Here's another point of interest. The same state law that allows the city to pass the rain tax also prohibits the revenue from the tax being used for anything except storm water and flood control. Given that there are no plans for any storm water and flood control projects or improvements and they can't use Rain Tax proceeds for anything else, how will they spend the projected $532,000.00 from the tax?

The new, first time ever $532,000.00 storm water budget includes $356,431.00 in salaries. But there are no plans to hire any new employees. The plan is to move the majority of street department employees salaries from the street department budget into the new storm water budget. This in turn will free up that money from the street department budget for the city to use however they want. In like matter, the $42,813.00 storm water manager salary will be moved from the codes enforcement budget to the storm water budget. In all the city will see a nearly $400,000.00 windfall in freed up funds all thanks to the rain tax.

The estimated rain tax revenue of $532,000.00 is equivalent to a thirty-two cent property tax increase and if passed will be the largest tax increase ever passed on city residents and businesses.

County residents won't necessarily escape the rain tax. There are several county owned properties within the city that will be hit by the rain tax. Those taxes will be paid by county tax payers.

The old vocational

school on Harrison Road-$300 per month.

The County Maintenance Building on Hwy 11-$100 per month.

The Loudon County Convenience Center-$100 per month.

The Roane State Building Co-owned by the city and county jointly-$100

per month.

And of course, the businesses that have to pay the rain tax will have no option but to pass the tax costs on to their customers in the form of higher prices that everyone will have to pay. Very much like the gas tax increase.

It's highly perplexing why city officials appear to be so determined to pass such a heavy tax on the citizens, property owners and businesses of the city. It's certainly not mandated and the city finances sure don't show the need for that much new revenue. So why do it?

The final vote on the Rain Tax will be June 26th, 7:00 at city hall. If you are opposed to an open ended, never ending new tax, you may want to contact Mayor Aikens and council persons and plan to attend the meeting to let them know.