| If you've been following

the drama of Loudon County schools vs. Lenoir City schools and who

needs money more, here's another chapter.

Friday, some commissioners received a letter from Lenoir City director of schools, Jennie Barker. Somehow she left me off that email list, I'm sure just an oversight. In this letter, she again takes issue with some of the information from my website, questioning the accuracy and that's OK. She takes issue with the numbers I posted from the Tennessee Department Of Education. She disagrees with how the TDOE comes up with those numbers. She disputes my claim that their fund balance is closer to eleven million dollars than nine million dollars. If she counts all fund balances, it's closer to the eleven million, if she only counts the general fund, it's closer to nine million. Either way she wants to count it, those are very healthy fund balances. Then Ms. Barker disputes that the county school system lost nearly $400,000.00 to the Lenoir city system. According to her, the county schools lost $371,826.26. That's pretty close to the reported $400,000.00. Here's the math, on July 6th, the county commission passed our 2021-2022 budget on a 7-3 vote, 6 is a majority. Included in that budget was additional funding going to county schools from the Adequate Schools Facility Tax, ASFT, to help offset the lost 400k, no wait, the lost $371,826.26 to the city system. The three budget no votes were due to the additional ASFT funding for the county schools. Commissioner Matthew Tinker was one of the no votes. Mr. Tinker is the second in charge of Loudon County schools. Mr. Tinker represents the second district which includes Lenoir City. His wife also works for the Lenoir City school system. Mr. Tinker is in a real tough spot. He's loses to some whichever way he votes. Commissioner Harold Duff, who represents the 5th district also voted NO. Commissioner Duff worked many, many years in the Lenoir City school system serving in every capacity including long time superintendent and has told us many times still holds a special feeling for the city school system, and that's understandable. Then there's Julia Hurley, I wouldn't even try to guess her motives. So the task before Ms. Barker is to try to flip three other commissioners to vote to take the additional ASFT money from the county schools and give it to the city schools. I wouldn't start to predict how this will turn out. There's no doubt the city school system has financial needs such as the planned $877,000.00 artificial turf on the football field and the baseball field or to spend $800,000.00 to remodel the high school cafeteria to make it more "cafe" like. But it's like the county schools have no need for additional revenue. Below are Ms. Barker's email, letter and my response if you have any interest in following along. Ms. Barker's email. Mayor and County Commissioners,

Again, I am concerned

about the challenge we are facing in Lenoir City Schools to

get accurate information presented publicly. In my career I

quickly learned that the decisions I make are only as good

as the information I have. So, I want you to have good

information.

Due to some inaccurate information that has been shared, my business manager, Mrs. Jeanie Mowery, has compiled information for you. I ask you to read the information attached below. Regards,

Jeanne

K. Barker, Ed.D.

Director of Schools

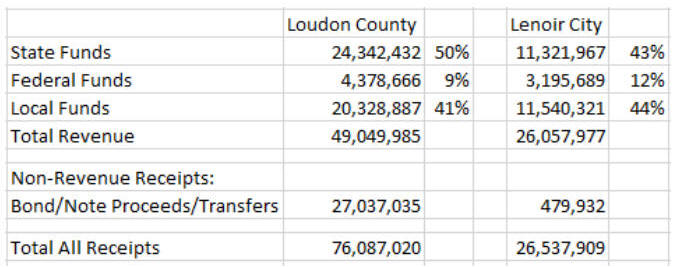

Ms. Barker's Letter REVENUE INFORMATION FOR LENOIR CITY AND LOUDON COUNTY SCHOOL DISTRICTS This information is in response to the article on Commissioner Van Shaver's blog comparing information from the Tennessee Department of Education's 2020 Report Card and other financial information for Loudon County & Lenoir City Schools. Mr. Shaver’s blog shows the following chart with information that was pulled from the Tennessee Department of Education’s 2020 Report Card for both school districts. He uses this information to conclude that county tax payers are paying 63% of all funding for Loudon County Schools and that the city’s percentage means that Lenoir City receives “far more from state and federal funding that does the county”. These conclusions are erroneous on several fronts. The percentage that the state shows on the Report Card for Per Pupil Local is misleading, since it includes non-revenue sources that are not usually included when calculating local revenue amounts. According to the FY20 Annual Statistical Report on the TDOE website, Loudon County received $26,998,308 in the bond, note & lease proceeds category. This could be amounts received from a new or re-financed bond or note and represents a one-time receipt, not an on-going source of revenue. A more accurate source for the local revenue percentage is Table 19 of the Annual Statistical Report. A complete breakdown of that information is shown below. This data reveals that Loudon County's percent of local funding is 41% without the nonrevenue receipts, instead of the 63% listed on the Report Card. These amounts also show that it is untrue that Lenoir City receives "far more" from state and federal funding than Loudon County.

It was stated in the blog article that Lenoir City had amassed nearly 10 million dollars in the fund balance. The General Purpose Fund undesignated fund balance did experience a one-time increase due to pandemic related reasons, bringing the audited fund balance to $9,014,098. State revenue collections were very low in the beginning months of the pandemic and as a result entities were advised to reduce revenue projections. Fortunately, revenue did not decrease as projected. In addition, since the state closed schools from March 2020 through the end of the school year, costs in many major expenditure categories such as utilities and student transportation were much less than projected. As a result of this unprecedented set of circumstances, our Board of Education chose to move the additional funds into the Capital Projects Fund to use for major renovations and additions. It was also mentioned in the article that the Loudon County System would be losing $400,000 to Lenoir City Schools through the BEP. This is not true. BEP funds are calculated based on each school systems average daily membership. If one school experiences a decrease in enrollment the BEP funds they lose are not gained by another school system. In addition, the state legislature passed “hold harmless” legislation for those school systems who experienced a loss of students due to the pandemic. This means that Loudon County will receive the same amount of BEP funding as in the previous year and may also receive the 4% salary improvement funds for 2021-2022. There was an adjustment of $371,826.26 in local tax funding to Loudon County Schools based on an annual calculation known as the Weighted Full Time Equivalency Average Daily Attendance. WFTEADA represents each school system's share of the total student enrollment in both districts. The WFTEADA adjustment is required by T.C.A. 49-3-315(5) so that county education revenue is shared equitably among all children in both districts. These reductions can affect both districts. Within the past 5 years, Lenoir City Schools has experienced reductions twice. My reply to Ms. Barker Ms. Barker,

I received your email from

a fellow commissioner. Apparently, you did not include me in the

email list. I'm sure that was just an oversight. No problem.

I have no problem with my information being challenged. However, as you said, my information came from the Tennessee Department Of Education. You should probably take your concerns to them in the way they present their information. Like you, I too have issues with how the TDOE arrives at some of their conclusions. Such as, determining the population split between school systems using a weighted system rather that actual enrollments. That really hurts the county school system. The numbers I used to derive at your fund balance comes from your most recent audit report on the comptrollers website.

I understand the difference between undesignated and restricted fund balances. So there is an argument for you to claim a $9,000,000.00 undesignated fund balance. Either one you use speaks highly of your system's impressive revenues.

As to the $400,000.00 loss

to the county school system, that number came to us from both

the county finance director and the county BOE finance director.

I'm sure it was just a rounding up issue. While you state the

loss was $371,826.26, that's pretty close to our number.

Speaking strictly for myself, whether the amount the county

school system lost was the 400k or the 300k it wouldn't have

altered my support for providing additional revenue to the

county system through the ASFT.

More than twenty years

ago, I started my website,

www.vanshaver.com, for the very reason you stated, to

try to get accurate information to as many people as

possible. My site is now the largest, most read local

website of it's kind.

I'll be more than happy to offer you the opportunity to refute, rebut or correct any information I post on my site any time. You're welcome to send any information you would like and I'll post it. Like you, I am concerned about the challenge of getting accurate information presented publicly. Van |