Tennessee gets 21.4 cents per gallon and the federal government gets 18.4 cents per gallon.

The first federal gasoline tax in the United States was created on

June 6, 1932 with the enactment of the Revenue Act of 1932 with a

tax of 1¢/gal. Since 1993, the U.S. federal gasoline tax has been

18.4¢/gal. Unlike most other goods in the US, the price displayed

includes all taxes, as opposed to inclusion at the point of

purchase.

About 60% of federal gas taxes are used for highway and bridge construction. The remaining 40% goes to earmarked programs. However, revenues from other taxes are also used in federal transportation programs.

Don't understand why the tax is included in the price at the pump. I guess it's the government's way to try to keep you from knowing how much they're sticking it to us.

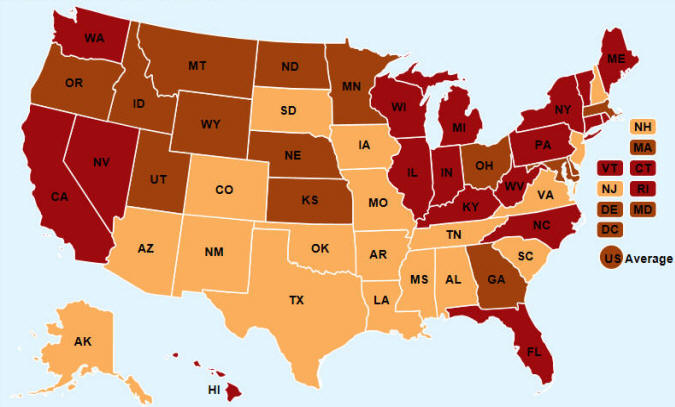

Below is a link to an interactive map of the US showing each states gas taxes. At least Tennessee's gas tax isn't as high as some others.