Our current property tax rate is $1.8587, or almost $1.86 per $100 of assessed value of your property. Still the fourth lowest tax rate in the state. The county operates on 186 pennies. The current approximate value of each of those property tax pennies is about $170,000.00 per.

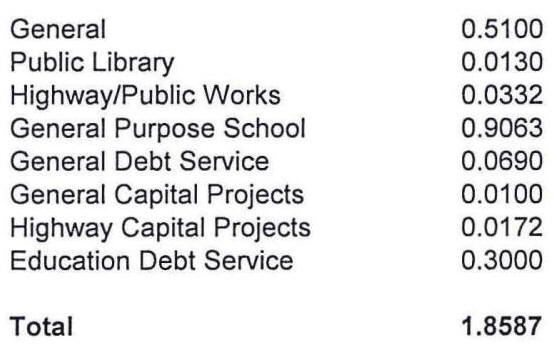

Those pennies are divided up among eight different departments of county government shown in the table below.

The county general fund gets 51 pennies. The general fund is responsible for nearly all county operations except education. Loudon County schools operating budget receive 90.63 of those pennies or just a tad less than 50% of all property taxes to run our nine schools. The school debt service gets another 30 pennies. These pennies cover the annual debt payment on the schools fifty million dollar plus debt. All together, a little over 120 of your tax pennies goes to education.

The remaining pennies are distributed as such, library's get 1.3 pennies, highway department gets 3.32 pennies, the county debt service gets 6.9 pennies. Incidentally, those pennies will pay the debt service on the new 15 million jail addition. General capitol projects gets 1 penny and the highway department capitol projects gets 1.72 pennies.

The next time You write that check to the county, you will know exactly where your taxes are going. 65% to the schools, 31% to county operations, 3% to the highway department.